Question :

This assessment will cover following questions:

- Explain the difference between management and financial accounting?

- What type of reports are produced from managerial accounting?

- Describe about the authentication of the information generated?

Answer :

INTRODUCTION

Management accounting can be understood as a form of accounting under that financial and non financial information regards to business transaction is recorded. The aim of this accounting is to help executive department of companies in better decision making by providing necessary information (Hemmer and Labro, 2017). The project report is based on detailed analysis of this accounting and for better understanding a company has been chosen that is Excite entertainment limited. The company operates in leisure and entertainment sector in United Kingdom. The report covers information about multiple types of MA and its reports. As well as about costing methods, budgeting and contribution & BEP.

Yo may also like to know about Assignmnet Help Services in USA

TASK 1

Section (A)

(a) Comparison between MA and financial accounting.

|

Basis |

Management accounting |

Financial accounting |

|

Objective |

Main objective of this accounting is to produce internal reports so that managers can take correct decisions. |

While this accounting's objective is to prepare financial statements in order to spread information about financial position to stakeholders. |

|

Information |

This accounting is based on two types of information that is regards to financial and non financial aspects. |

On the other side, this accounting is based on only financial information. |

|

Necessity |

It is not compulsory for corporations to apply this accounting to manage their transactions. |

While it is necessary to listed companies to implement this accounting for managing financial transactions. |

(b) Cost accounting system- It can be understood as a form of accounting which is related to making projection of futuristic expenses and managing overall cost. This is essential for companies to apply in their functions so that actual cost and variances can be computed. In the absence of this accounting system, it may become difficult to overcome from adverse variances. This accounting system is not only limited till any particular cost management but also under it direct & standard costs are also managed (Cooper, 2017). For instance, it is being applied in the Excite entertainment limited company with an aim of managing cost of different operations related to organising any event or function.

(c) Inventory management system- This is an accounting system that is related with process of controlling & managing quantity of various forms of stock including raw material, prepared products etc. It is based on the techniques of inventory valuation like LIFO, FIFO and weighted average cost. It is essential for companies in order to update level of stock on daily basis so that this can be find out how much stock has been used in manufacturing and how much quantity of raw material remained in warehouse. For example in above company, their event managers apply this accounting system to track availability of different musical instruments.

(d) Job costing system- It is defined as a type of accounting system that is aligned with calculating cost of job separately. This is important for companies to know about how much cost has been occurred in completing any particular task. Under this accounting system various types of costs are calculated such as labour cost, direct material cost and overheads. For example in the Excite entertainment limited company, they apply this accounting system with an aim of providing detailed information to finance department about cost of job.

(e) Benefits of above mentioned accounting systems-

- Cost accounting system- This accounting system is based on calculating and managing overall expenditures. For instance in Excite entertainment limited company, their finance managers make accurate prediction of futuristic cost and keeps control over unwanted expenditures.

- Inventory management system- It is based on the application of applying various inventory valuation method in order to update and track usage of materials (Leung, 2016). Such as in the above company, they apply this accounting system to provide essential information to managers regards to quantity of overall material stored in warehouses.

- Job costing system- This is related to calculating cost of job separately. Like in the Excite entertainment limited company, their managers apply this accounting system in order to manage and track cost of job in an effective manner.

Section (B)

(a) Different types of managerial accounting reports.

- Performance report- Under this report information regards to performance of each aspect is included. The purpose of preparing this report is to help managers in order to take suitable steps related to progress and promotion of employees as per their actual performance.

- Accounts receivable ageing report- It is a report which includes information relating to total debtors or customers whose payment is not made by them. In the Excite limited company, their accountant manages this report for tracking those customers whose amount is outstanding.

- Budget report- In this report, information about estimated and actual financial outcome is included (Debnath, 2017). Like in the above company, they prepare this report for managing monetary performance.

(b) Why information should be accurate, relevant and up to date.

This is necessary to keep financial information accurate, relevant and up to date. It is so because if information will accurate then this will be easier for accountants to prepare financial statements. Along with there should be relevancy of financial data with companies transactions so that internal decisions can be taken out by managers. Same as, it is compulsory to present financial information on right time so that stakeholders can become aware about companies' performance.

(c) How MAS and MA reports integrated with operational process.

The operational process of Excite entertainment limited company has been integrated with accounting system such as cost accounting system, stock management etc. This is so because their finance department track and control overall cost as well as their production department also linked to stock management system for managing quantity of materials. Same as MA reports are also integrated to their business process.

Conclusion- On the basis of this section of project report, it can be concluded that implementation of MA is necessity for companies. Report concludes about integration of MA and MA reports with chosen business.

Summary- The project report summarise about role of MA for companies and necessity of its systems for companies. Report abstracts that different departments of corporations are aligned to reports of this accounting.

TASK 2

- Calculations with tables-

Income statement as per absorption costing:

|

Particular |

Amount (values in pounds) |

|

|

Revenues (8000 units @15 pounds per unit) |

120000 |

|

|

Less : Cost of good sold- Opening stock (500 units @ 10 pounds per unit) Production cost (10000 units @10 pounds per unit) |

5000 100000 |

|

|

Less- Closing stock (2500 units @10 pounds per unit) |

25000 |

|

|

Absorption cost |

80000 |

|

|

Net Profit |

40000 |

Income statement as per marginal costing:

|

Particular |

Amount (values in pounds) |

|

|

Revenues (8000 units @15 pounds per unit) |

120000 |

|

|

Less: Variable cost Opening stock (500 units @ 6 pounds per unit) Marginal cost of production (10000 units @ 6 pounds per unit) |

3000 60000 |

|

|

Less: Closing stock (2500 units @ 6 pounds per unit) |

15000 |

|

|

Marginal cost of sale |

48000 |

|

|

Contribution (15-6)= 9 x 8000 |

72000 |

|

|

Fixed cost |

40000 |

|

|

Net Profit |

32000 |

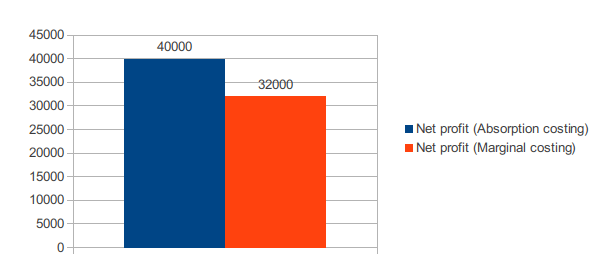

Analysis- The above graph is showing that there is variation in calculated profit under absorption and marginal costing. Like in the absorption costing, value of profit is of 40000 pounds and in the marginal costing it is of 32000 pounds.

- Definitions-

Absorption costing- It can be understood as a type of costing method in which all types of cost is absorbed completely during preparation of financial statements. In this method, fixed cost and variable cost both are considered as cost of product.

Marginal costing- This costing technique considers cost in different manner as under it, fixed cost is assigned as period cost (Smith, 2015). On the other hand, variable cost is assigned as cost of unit. Under this method, various types of occurred cost is categorised and used for preparation of financial statements. As well as this costing method has completely different features in compare to absorption costing.

- Advantages and disadvantages of absorption & marginal costing.

Absorption costing-

Benefits- This is beneficial in order to understand role of including fixed production cost in product analysis and applying effective pricing policy. As well as prices on the basis of absorption costing assures that all costs have be covered. Along with this costing technique, avoids the breakup of costs in fixed and variable aspects that can not be done effectively.

Drawbacks- This costing technique is not beneficial in order to take effective managerial judgements like selection of appropriate product mix, option of alternatives, number of units needed to be sold to gain profit etc. Apart from it, this is not suitable in order to produce flexible budget because of lack of distinction between fixed and non fixed cost.

Marginal costing-

Benefits- This costing technique is quite simple to use and understand. As well as it contributes in effective cost control because this divides total cost into fixed and variable cost (Harrison and Lock, 2017). Hence by focusing on all efforts on variable cost can control the cost.

Drawbacks- Along with the benefits, this technique has some limitation also such as it is based on unrealistic assumption that all cost may be divided into fixed and variable costs. In addition, information of marginal costing can become unrealistic in the situation of variation in level of production.

TASK 3

- Budgeting- The term budgeting can be defined as a systematic procedure of making comprehensive estimation of futuristic amounts. There are basically, two types of budgeting which are as:

- Operational budgeting- Under this types of budgeting prediction of different aspects is being done for next accounting year. Under it, various budgets are included such as:

Sales budget- It can be defined as a type of budget which forecasts quantity of sales units and revenues for upcoming time frame (Arnaboldi, Lapsley and Steccolini, 2015). This is suitable for companies in order to manage overall activities and functions regards to sales. Like in the above company, they prepare this budget for managing revenues from organised events.

Production budget- This is a type of budget which is related to making projection of total production units and expenditures that may occur in process of manufacturing. Like in the Excite entertainment limited company, their accountant prepare this budget for better management of cost regards to entertainment aspects.

Overhead budget- It can be defined as a type of budget which is related to making estimation of total overheads which may incur in order to complete different sort of activities.

- Capital budgeting- This can be defined as a type of budgeting technique that is related to estimating efficiency of different types of projects (Al-Qady and El-Helbawy, 2016). It is useful for those projects whose size is larger. Under this budgeting technique, estimation of project is being done by help of various methods such as payback period, net present value, internal rate of return and accounting rate of return. Like the above company can analyse efficiency of their projects by help of this budgeting.

- Break even analysis- It can be defined as a type of financial tool which help in order to assess a particular level at which company may generate profit. In terms of simple words, it is a type of financial computation for determining quantitative aspect of products of a company must sell to recover its cost. Basically, break even is a situation at which corporation may not make money or lose money but can cover all the cost.

Components of break even analysis- There are mainly, two types of components of break even analysis which are mentioned below in such manner:

- Fixed cost- This is also known overhead cost which is directly related to level production, but not with quantity of manufacturing. It consists interest, tax, rent and many more.

- Variable cost- It can be defined as a type of cost that may increase or decrease in proportionate of volume of production. This includes cost like raw material cost, packaging cost, fuel and many more.

There is a particular formula in order to calculate break even point as well as this is measured in term of units and value. Herein, underneath formula to calculate Break even point is mentioned in such manner:

Break even point (in units) = Fixed cost / contribution per unit.

Break even point (in values) = Fixed cost / profit-volume ratio

- Standard costing and variable analysis-

Standard costing- This can be defined as a type of costing technique in which cost of various aspects is estimated. On the basis of this, it becomes easier for companies in order to make comparison of actual cost. This is so because in accordance of estimated cost, finance managers make compare of actual cost. It has some advantages like:

- This costing technique is useful for preparation of budget because by help of it, accountants can add value of estimated costs in budget (Ahrens and Khalifa, 2015).

- Along with this is useful for managerial planning and for effective decision-making.

- The standard costing technique is more reasonable and effective measurement of stock.

Variable analysis- It can be defined as process of calculating variance or difference between actual and planned aspects. This type of analysis is too useful in order to managing effective control over business. For instance, budget for sales is of 15000 pounds and actual sales is of 12000 pounds so variance will be of 3000 pounds. Herein, this is important to know that variance is being calculated in both positive and negative manner which is mentioned below-

Adverse variable- This occurs when actual cost is higher then the estimated cost. It is considered as negative situation. Below example of adverse variable is mentioned-

|

Particulars |

Actual cost |

Estimated cost |

Variance |

|

Manufacturing cost |

500 |

700 |

200 (A) |

|

Purchasing cost |

800 |

900 |

100 (A) |

Favourable variable- This occurs when actual cost is lower then the estimated cost. It is considered as positive situation. For example:

|

Particulars |

Actual cost |

Estimated cost |

Variance |

|

Manufacturing cost |

700 |

500 |

200 (F) |

|

Purchasing cost |

900 |

800 |

100 (F) |

TASK 4

- Contribution margin- This can be defined as variation between sales and variable cost. In accordance of given data, calculation of contribution margin is done below in such manner:

|

Particulars |

Amount (Values in pounds) |

|

Selling price per unit |

40 |

|

Less- Variable cost per unit |

10 |

|

Contribution per unit |

30 |

- Break even point- It is defined as a point on which companies do not generate profit and do not face loss. As per the given data, calculation of BEP is done below:

|

Particulars |

Amount (Values in pounds) |

|

Fixed cost (A) |

120000 |

|

Contribution per unit (B) |

30 |

|

Break even points (A/B) |

4000 |

- Units to achieve- In this task of project report, units are estimated on which company can genrate desired level of profit.

Units to attain desired profit = Fixed cost + Desired profit / Contribution per unit

|

Particulars |

Amount (Values in pounds) |

|

Fixed cost |

120000 |

|

Desired profit |

90000 |

|

Contribution per unit |

30 |

|

Units to attain desired profit |

7000 units |

- Sensitivity analysis- It can be defined as a type of technique which is being used in order to evaluate different business decisions, employing various assumption related to variable (Kerr, Rouse and de Villiers, 2015). For instance, an expert of finace can analyse expected level of profit which may be achieved as an outcome of an investment in machine by projected level of demand, cost of material etc.

A common important aspect of sensitivity analysis is to find out those variables which can have an huge impact on results of analysis. As well as the judgement maker can then assess the possibilities of variables facing valuable changes. The output is an effective understanding of risk which is aligned with a particular investment. In addition, method to create sensitivity analysis is to add variables into three case that are worst case, most likely case and best case.

- Assumption of breakeven point analysis-

In the break even point analysis, various types of assumptions are being made. Herein, underneath some key assumption which are created during calculation of break even point are mentioned in such manner:

- All types of cost can be divided into two segments which are fixed and variable cost.

- Fixed cost will remain constant at all volume of production (Brierley and Gwilliam, 2017). In simple terms, this is assumed that fixed cost will be similar while production will increase or decrease.

- On the other side, variable cost will fluctuate in proportionate of volume of manufacturing. This assumption is completely opposite of above assumption which states that value of variable cost will change if production will raise or decrease.

- Another assumption in the break even point is that selling price will remain unchanged. This will not affect due to the change in volume of production or any other factor.

- As well as product mix will also remain constant. It will not be affected because of variation in any other factor.

- The break even point analysis assumes a fixed rate of increasing in variable cost.

- This assumes a fixed technology and no any enhancement in the efficiency of labour.

- In the situation when there is condition of multipale production company then product mix will be unchanged or stable.

- The volume of sales and production are assumed to be equal in break even point analysis.

- Any variation in the input prices are ruled out.

- The sum of revenue will raise with increasing number of manufactured units. In other terms, this assumption of break even analysis point states that total amount of sales revenues can be increase if a company will produce higher number of units.

- Company manufactures only one product.

- The volume of cost and revenues fluctuate in accordance of variation in the total sales revenues.

So, these are some assumption of break even point analysis. These all assumptions are not to be possible in practical sense. This is so because some assumption are totally impossible to happen in companies (Monden, 2019). For example one assumption states that company produce only one product that is not possible in the companies. As well as there are some other assumptions also which seems wrong. For instance, assumption of increasing in variable cost at a fixed rate is not possible because variable cost can be increase or decrease in accordance of change in production or sales.

You may also like to read - Management Accounting Techniques and Methods Used by Oshodi Plc

REFERENCES

Books and journal:

Hemmer, T. and Labro, E., 2017. Management Accounting and Operations Management. In The Routledge Companion to Production and Operations Management (pp. 345-359). Routledge.

Cooper, R., 2017. Supply chain development for the lean enterprise: interorganizational cost management. Routledge.

Leung, D., 2016. Inside accounting: the sociology of financial reporting and auditing. Routledge.

Debnath, S., 2017. Implementing environmental management accounting (EMA): A case study from India. In Corporations and Sustainability (pp. 28-48). Routledge.

Smith, S .S., 2015. Accounting: Evolving for an integrated future. Journal of Accounting, Finance & Management Strategy. 10(1). p.1.

Harrison, F. and Lock, D., 2017. Advanced project management: a structured approach. Routledge.