Question :

This assessment will cover following questions:

- Financial Management Assessment helps in decision making in financial aspects. Critically evaluated the important strategic decisions that a business may have to make and appreciated how accounting and finance can assist in making and evaluating those decisions.

- Financial Management Assessment helps in main financial management and risks in business. Generate an understanding of specific analytical skills in key decision areas within strategy and finance at local and international level.

Answer :

INTRODUCTION

The term financial management can be defined as a process of collecting, analyzing, and interpreting financial data with the help of a vital range of techniques and methods (Knauer and Wöhrmann, 2013). This is essential for companies to manage their financial resources so that maximum utilization can become possible. The aim of the project report is to understand the importance of financial management for companies. The project report is based on two questions that are related to equity financing and investment appraisal techniques in order to assess the efficiency of the project.

MAIN BODY

Question 2. Long-term finance

- Issue of Right share- Right share issue can be identified as a method of inviting minority shareholders to buy additional new stock in the business entities. This type of issue gives current shareholders bonds which are known as a right (Fan, 2015). Due to this issue of rights, shareholders of companies become able to make purchases of new shares at a discounted rate in the futuristic time period. Like Love-well limited company, they require financial assistance and for this purpose, they issued the right shares. Herein, below some computation related to the issue of right shares has been done in such manner:

Shares which Lexbel Plc needs to issue = 180000 GBP

The market price of the current ex-dividend of Lexbel Plc = 1.90GBP

- 3 assorted rights-issue prices recommended by the corporation's finance director: GBP1.80, GBP 1.60 and GBP1.40

|

Right issue of Lexbel plc |

|

|

Aggregate (no.)Ordinary shares (@ 50 for each) |

300000 Pounds |

|

Add: Aggregate Reserve |

400000 Pounds |

|

Whole Sum |

700000 Pounds |

|

Profit Post taxation ( 700000 pounds x 20 percent) |

140000 Pounds |

|

(I) Number of shares to be issued = (Aggregate Funds to be elevated/right issue prices) |

|||

|

Description |

Amount (in pound except shares) |

Amount (in pound except shares) |

Amount (in pound except shares) |

|

Exist number of share |

600000 |

600000 |

600000 |

|

Fund to be raised (A) |

180000 |

180000 |

180000 |

|

Suggested right issue prices (B) |

1.8 |

1.6 |

1.4 |

|

Number of shares to be issued (A/B) |

100000 |

112500 |

128571.43 |

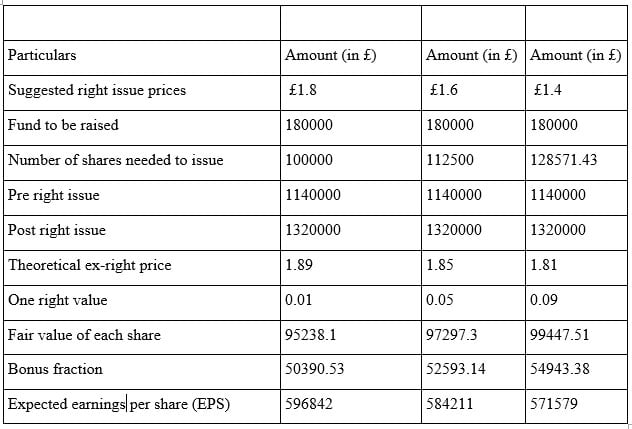

(ii) Theoretical ex price – In short form, this is known as TERP. It can be described as some type of scenario where stock and right are added to stock. The value of the theoretical ex price is determined by price of the stock of a corporation after the issuance of new right shares together with the expectation that all new issued shares are taken into account by current stakeholders (Gurd and Thomas, 2012). Ultimately, the goal of this kind of share is to generate additional capital by granting them preference with current shareholders. Security rights offerings can be standard for shareholders. This is because by the time of the right provided they will generate arbitration.

|

Particulars |

Condition one |

Condition two |

Condition third |

|

Recommended right issue prices |

1.8 GBP |

1.6 GBP |

1.4 GBP |

|

Fund to be increased |

180000 GBP |

180000 GBP |

180000 GBP |

|

Number of shares required to issue |

1 lac shares |

1.125 lac shares |

128571.43shares |

|

Pre right issue |

1140000 |

1140000 |

1140000 |

|

Post right issue |

1320000 |

1320000 |

1320000 |

|

Theoretical ex-right price |

1.89 |

1.85 |

1.81 |

(iii) Anticipated earnings per share (EPS) = It is calculated from a formula that is mentioned below in such manner:

Share before issue of rights x TERP/ Current market price.

In aspect of above given case, this can be find out that:

Recent market rate = 1.9

Number of shares available = 600000 shares

Return on shareholders’ fund = 140000 GBP

(iv) Form of issue of right issue price:

|

Particular |

Amount (in GBP) |

Amount (in GBP) |

Amount (in GBP) |

|

Recommended right issue prices |

1.8 |

1.6 |

1.4 |

|

Fund to be increase |

180000 |

180000 |

180000 |

|

Number of shares to be issued: |

100000 |

112500 |

128571.43 |

|

Exist number of shares |

600000 |

600000 |

600000 |

|

Ratio of new share to existing one |

0.17 |

0.19 |

0.21 |

|

Issue of right share hold by present shareholder |

Issue of 1 for 6 right shares hold |

Issue of 9 for 48 right shares hold |

Issue of 3 for 14 right shares hold |

Analysis: In accordance of above done calculations, herein below three options can be drawn that are as follows:

- 1stalternative is related to issue of rights @ rate of 1.8 will be 1 lac shares for each. Thus, shareholders should allocate pro-rata one share to remained six shares.

- 2ndalternative is regards to issue of rights @ rate of 1.6 will be 112500 shares for each. Thus, shareholders should allocate pro-rata one share to remained 48 shares.

- 3rdalternative is related to issue of rights @ rate of 1.7 will be 128571.43 shares for each. Thus, shareholders should allocate pro-rata one share to remained 14 shares.

(v) Evaluation of best option among these above mentioned alternatives.

In conjunction with the three alternatives listed above, it can be found that the proposed correct share value of 1.8 pound for each share will be advantageous with the above-mentioned company. It's so because in this option the value of the projected earnings per share is higher as opposed to the other two options.

(vi) Evaluate the benefits of scrip divided in context of shareholders or companies.

Scrip dividend - This can be described as a form of dividend provided by businesses, rather than a standard dividend. For all those corporations that issue lack of cash dividends, it is being efficient (Jiang and Kim, 2013). Shareholders can receive scrip dividend as an option to currency dividend to hold their dividend. This form of dividend is essentially ideal for both stakeholders and business. That's because customers don't have to pay any transaction fees, commissions, etc. As for enterprises, preserving cash dividend for the remainder of business transactions is simpler. It consists below mentioned benefits and drawbacks which are as follows:

Benefits of scrip dividend for business entities-

- This is advantageous for businesses in order to retain a successful cash balance. It's because they have the right to sell shares under this company instead of paying cash dividends.

- Therefore, the issuance of scrip dividends leads to an increase in the equity and gearing conditions of entities. This is because issuing shares as a dividend as opposed to cash keeps them in enhanced state of leverage.

- A business that has strong credibility and brand value will issue such shares when they don't have sufficient cash to pay stakeholders.

- Furthermore, whether businesses pay a scrip dividend at a lower interest rate than their share prices will not impact it. At the other side, this is not true in the situation of cash dividend because if a company holds lower cash dividend then its share prices the decline.

- In addition, it is considered as one of the key source of finance except of cash dividend.

Advantages of scrip dividend for shareholders:

- The prime advantage of scrip dividend for stakeholders is that it helps them in making savings of tax (Guess and Ma, 2015).

- It contributes effectively to shareholders who are needed to increase their ownership in any company.

- This types of dividend is useful for shareholders in order to making saving of cost of transactions.

- The scrip dividend helps to shareholders in the aspect of financial benefit due to time interval of cash dividend.

- This dividend helpful for shareholders for increasing their equity without making any additional charges such as commission, buying cost and many more.

Question 3 Investment appraisal techniques

Overview of task- Under this task of project report, different types of calculations has been done regards to investment appraisal techniques as well as project is evaluated in an effective manner by help of methods. Herein, below some calculations are mentioned which are as follows:

(a) Calculation

(i) Payback period method- Initial investment/cash flow (If cash flow will equal)

Initial investment = 275000 GBP

Cash flow = Expected annual cash inflow – cash outflow

= 85000 – 12500

= 72500 GBP

So, cash flow = 275000 / 72500

= 3.79 years

So cost of this project will be covered under 3 years and few months.

(ii) Accounting rate of return- Cash flow after depreciation / Initial investment x 100

Initial investment = 275000 pounds

|

Particulars |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

|

Cash In-flow |

85000 |

85000 |

85000 |

85000 |

85000 |

85000 |

|

(-) Cash out-flow |

12500 |

12500 |

12500 |

12500 |

12500 |

12500 |

|

Net Cash flow |

72500 |

72500 |

72500 |

72500 |

72500 |

72500 |

|

(-) Depreciation (on the basis of straight line method @ 15%) |

38958.33 |

38958.33 |

38958.33 |

38958.33 |

38958.33 |

38958.33 |

|

Net Cash flows after depreciation |

33541.67 |

33541.67 |

33541.67 |

33541.67 |

33541.67 |

33541.67 |

|

Initial investment |

275000 |

|||||

|

Accounting rate of return |

12.1969709091 |

Working Notes:

|

Working Note: |

|

|

Calculation of depreciation: |

|

|

cost of machine |

275000 |

|

scrap value |

41250 |

|

Life of machine |

38958.3333333333 |

|

Depreciation |

(iii) Net present value = Discounted cash flow – Initial investment

|

Years |

|||

|

NPV= Discounted cash flow – initial investment |

|||

|

Initial investment= |

275000 |

||

|

Net Cash flow |

PV factor @ 12% |

Discounted cash flow |

|

|

Year 1 |

72500 |

0.892 |

64670 |

|

Year 2 |

72500 |

0.797 |

57782 |

|

Year 3 |

72500 |

0.711 |

51547 |

|

Year 4 |

72500 |

0.635 |

46037 |

|

Year 5 |

72500 |

0.567 |

41107 |

|

Year 6 |

72500 |

0.506 |

36685 |

|

Scarp Value |

41250 |

0.506 |

20872 |

|

Discounted Cash Flow |

318700 |

||

Net Present value (NPV) = 318700 - 275000

= 43700 GBP

(iv) Internal Rate of Return (IRR) = LDR + PV of LDR – Initial investment / PV of HDR – PV of LDR (HDR – LDR)

PV at 12%:

|

Years |

Cash flow |

PV at 12% |

Discounted cash flow |

|

Year 1 |

72500 |

0.892 |

64670 |

|

Year 2 |

72500 |

0.797 |

57782 |

|

Year 3 |

72500 |

0.711 |

51547 |

|

Year 4 |

72500 |

0.635 |

46037 |

|

Year 5 |

72500 |

0.567 |

41107 |

|

Year 6 |

72500 |

0.506 |

36685 |

|

Scrap value |

41250 |

0.506 |

20872 |

|

Total Present value @ 12% |

318700 |

||

PV at 20%:

|

Years |

Cash inflow |

PV factor @ 20% |

Discounted value |

|

1 |

72500 |

0.833 |

60392 |

|

2 |

72500 |

0.694 |

50315 |

|

3 |

72500 |

0.579 |

41977 |

|

4 |

72500 |

0.482 |

34945 |

|

5 |

72500 |

0.402 |

29145 |

|

6 |

72500 |

0.335 |

24287 |

|

Scrap value |

41250 |

0.335 |

13818 |

|

Total Present value @ 20% |

254880 |

||

Interval Rate of Return (IRR) = 12 + ( 318703 – 275000 ) / ( 254881 – 318703 ) * ( 20 – 12 )

= 12 + 43703 / -63881 * ( 8 )

= 12 + ( -0.68 ) * 8

= 12 – 5.44

= 6.56 %

Students Also Like to Read About: Financial Management Intoduction to Vodafone

Recommendation:

- Payback period- Based on the above described methodology, it can be ascertained that project costs will be recovered within 3.79 years. It indicates that this project may be advantageous for the above organization as it will recoup the cost of 275000 GBP in a quicker time frame.

- Accounting rate of return- Within this approach the expected profit rate is calculated so that project performance can be measured. Based on the volume of ARR estimated above, this can be found that the output of the business would create profit from a rate of 12.19%. So it will be advantageous for Love-well limited company to make investment in the business.

- Net present value- Love-well company's net present value for the project is 43700 pounds that is greater. It indicates that they will benefit from the project if they take investments in this venture because its present value is stronger

- Internal rate of return- The internal rate of return on the Love-well business project is 6.76%. This suggests that it will be good for them to make investment in this plan as project provides greater return.

So above mentioned recommendation stats that above Love-well company should acquire the project as all techniques are showing positive result.

b. Critical evaluation of investment appraisal techniques with the help of its benefits & drawbacks

Payback period- It is a type of technique which is linked to process of computing estimated time period that may occur in process of covering total investment amount (Shi, 2013). In the aspect of above Love-well company, this technique has been applied in order to assess projected time period. It has some limitations and benefits which are as follows:

Benefits-

- The major benefit of this technique is that it is very easier to use and simple to compute estimated time frame for project's cost recovery (Dimitropoulos and Tsagkanos, 2012). It needs some simple data to calculate payback period which are cash flow and value of investment.

- Apart from it, this method is useful in the aspect of uncertainties because by help of it, companies can evaluate project effectively.

Drawbacks-

- Under this method, time frame factor is ignored. Though, this factor is necessary to include during analysis of efficiency of projects.

- Along with the ignorance of time factor, it does not consists all cash flows.

Accounting rate of return- This technique is often known as average rate of return. The average rate of return on various projects is determined on which income can be produced (Gale and Ross, 2017). Such as in the project of the above client, this technique was implemented to evaluate project performance. Herein, underneath some key benefits and drawbacks of this technique are mentioned which are as follows:

Benefits-

- This is the fundamental thing that the firm's project team knows. It includes the total time-saving with an operation total life. After tax and depreciation the ARR embraces the concept of net income.

- The ARR strategy gives a good picture of the ventures' sales proportions for the company. It also takes into consideration the concept of bookkeeping for assessing benefit at different stages (. Linnerooth-Bayer and Hochrainer-Stigler, 2015).

Drawbacks-

- This technique does not concentrate on the time value of money, but managers use it to focus on various sources of financing with lower returns over a long period.

- As well as this technique is not suitable in the aspect of those projects under that investments are made in accordance of partial base.

Net present value method- It can be defined as a type of technique in that current value of different kinds of projects are evaluated. Under this technique, value of project is being determined by making variation between discounted cash and initial investment (Aouni, Colapinto and La Torre, 2014). Basically, net present value method is being applied in most of the companies as it offers most appropriate results. Such as in the aspect of above Love-well plc this technique has been applied in order to compute net present value of their project. Herein, underneath some key benefits and drawbacks of this technique are mentioned which are as follows:

Benefits-

- The Net Present value equation covers any cash inflow at the investing period. This is required for the money provider to bring all cash flow in to the account and to determine the present value.

- Each structure takes into consideration the risk factor used for assessing the cash flow of the various projects. This risk includes the likelihood of enterprises expenditures and initiatives being introduced in different investment programmes.

Drawbacks-

- Under the NPV approach, it is difficult to evaluate the various projects in the same sector at an economic cost to choose another program. The pace at which cash flows are to be cut is complex for the executive team.

- Many times it is not simple for the shareholder to make a successful option as the returns on investment are very good for the business. Primarily the NPV approach does not include capital allocation so it is not that possible to choose the investment.

Related Services: Assignment Help

Internal rate of return method- This method of analysing efficiency of projects is one of the basic method. Under it, rate of return is computed on which project will generate revenues (Albu and Albu, 2012). In the aspect of above Love-well plc, this technique is being applied in order to calculate rate of return of their project on which it produce return. Same as the above techniques, it also has some benefits and drawbacks which are as follows:

Benefits-

- It consists the time value of money factor that is critical element in order to help assessing beneficial alternative among various projects.

- As well as this technique does not consider rate of return aspect for evaluating the cash inflows.

Drawbacks-

- This technique does not consider some major factors such as size of project, future cost and many more.

- As well as this technique can not be applied on mutually exclusive projects (Zhu, 2012).

CONCLUSION

On the basis of above project report, it has been concluded that financial management is the key of success of business entities. The report is divided into two parts in which first part concludes about issue of right share concept and on the basis of it various calculations has been done. As well as scrip dividend and its benefits for shareholder and company is mentioned under report. The second part of report articulates about different types of investment appraisal techniques such as IRR, NPV and many more. In accordance of applied techniques of investment appraisal this can be concluded that above company should acquir