Question :

Management practice involves many functions which are required by the managers to perform so that the roles and responsibilities of the managers can be done effectively. The main functions of the management involve planning, organising, directing, staffing and controlling. The business of Woolworths company is divided into many departments so that management functions can be performed efficiently.

- What are the functions of management?

- What is the organisational structure of Woolworths?

- What is the role of different departments of Woolworths?

Answer :

Management is defined as the process in which various dimensions are included such as planning of human resources and any other aspects, organizing, leading, and motivating people within organizing due to which goals can be aligned inappropriate manner. Management is regarded as the strategy that is helpful for the business to manage various functions and acquire major benefits that could lead the business to succeed. Woolworths is an Australian chain of supermarkets that is associated with providing homeware, fashion, and food groceries to their customers. In order or get success the major requirement for Woolworths is that the company manage their business in such a way that they use their resources inappropriate manner so as to grab market prominence and sustainability as well. Management business within Woolworths is classified into various sub-functions such as planning, organizing, directing, and controlling. In this manner, Woolworths is managing its business functions and dealing with any coming complexities so as to reach its ultimate objectives indirect manner. There are various departments exist within Woolworths and they all are interconnected in such a way that all the working are interlinked so a succession of one department may lead to a succession of the other department as well.

There are various styles of management that can be used by businesses such as traditional approach of management, scientific approach, human relations approaches, contingency approaches, and many more. Woolworths is dedicated to providing better experiences to their customers and for this, the company is merging all their departments so that to provide collaborative working and incorporation of various aspects.

(Illustration 1: Woolworths Purpose)

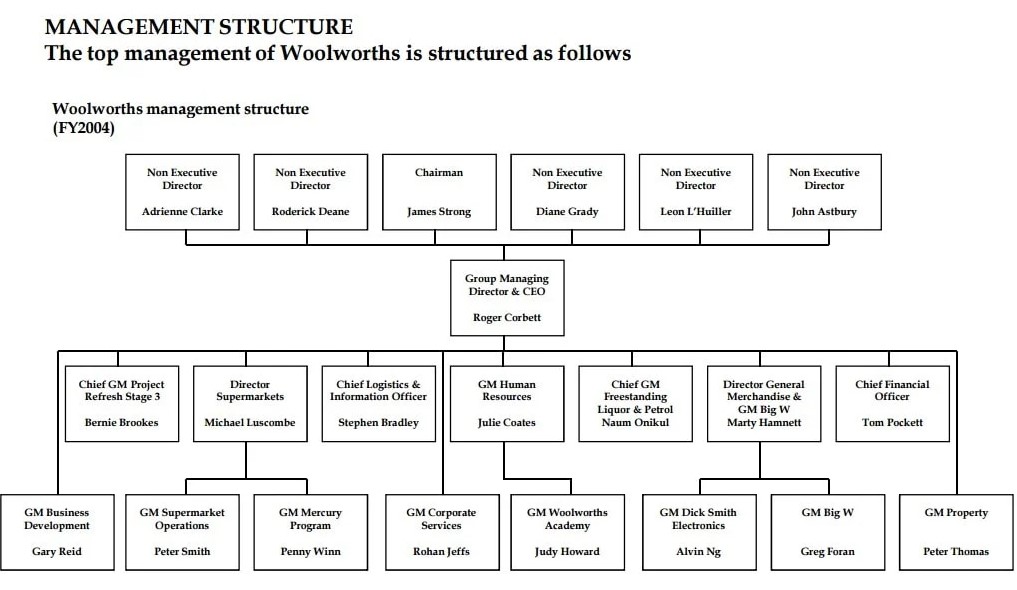

Woolworths is an international organization which is having business in various countries, this is the reason that the company has robust managerial sustainability which is leading the whole organization to stick to their objectives and attain the same in the specified time frame. On the other hand organizational structure is the other reason for the market prominence of Woolworths as the company can communicate with their departments in a direct manner which avoids the occurrence of various challenges and complexities. Business management is leading the company to acknowledge all the executed efforts in the direction of attaining goals in which direct establishment can be provided to Woolworths.

The organizational structure reflects a system that focuses on how various activities are directed in the company so that it can easily achieve the targets of the organization. The respective activities include roles, rules, and at last responsibilities. Organizational structure also determines the manner through which information flows between different stages/ levels in the company. It also explains various activities that should be delegated to achieve the goals of the organization. It is also known as pattern and network based on relationships that present in various positions. In an organization, two types of structure are designed in horizontal & vertical dimensions to achieve common objectives. If a systematic organizational structure is adopted it helps in clearly defining authority, objectives can easily be understood and according to that policies in the corporates are framed. It also supports coordination and diversification of the activities that lead to business growth. It becomes possible to frame policies.

Organizational structure also lays down both channels and adopts the pattern for communication. It results in proper administration. It also reduces or eliminates duplication of functions and tries to achieve production at maximum level by putting in minimum effort. Woolworths is a large chain of supermarkets and grocery stores as it was founded in 1924. The brand has its headquarters in Bella Vista, Australia. Woolworths adopts a flat structure in their organisation in which there are many branches exist as these are Human resource management, Sales department, marketing unit, finance department, etc. In the HR branch of Woolworths, all the work related to the appointment of a person to fill the vacant position is performed. The managers and executives of respective departments also deal in employment benefits like records and payment of gratuity, provident fund, pension scheme, Employees state insurance corporation, payment of minimum wages, maternity benefits, and it is their duty to adopt all laws related to employment. The sales department of Woolworths takes initiative steps to increase the level of sales in different stores and locations so that businesses can survive easily in the world of competition. It is the duty of the sales unit to deliver goods and services on time so that their audience is satisfied and keeps in touch with Woolworths for the long term. As the working of sales and marketing department are interlinked and interdependent. The marketing executives of the marketing branch of Woolworths take initiative steps to create awareness about their brand and product by advertising through various modes like distribution pamphlets, providing information on radios, giving advertisements on televisions, make promotion on social media like Facebook, Instagram, Twitter etc. as by using these modes the brand Woolworth create awareness and capture the large market area. That leads to increased sales and revenue which tends to business expansion and growth. The organization also has a finance department that deals in matters that are related to money in this various account executives are present. Accounts managers control the performance of executives by checking the work from time to time. All the transactions that make an impact on profit are recorded by the executive of the finance department. These units are also responsible for making arrangement regarding the amount related to working capital which are needed to run the day-to-day activities of the business. All the tax benefits and deductions are done by the department in the company Woolworths.

Related Service:

Thesis Writing Service

Which of the Following is NOT a Common Feature of a Financial Institution?