Question :

This assessment will cover the following questions:

- Evaluate the concept of CVP analysis and explain its importance in the financial management of a travel and tourism business such as EUROCARIB tour operators.

- Explain the various types of management accounting information that could be used in EUROCARIB tour operators.

- EUROCARIB tour operators is London based tour operators. Assess the use of investment appraisal techniques as decision-making tools.

Answer :

INTRODUCTION

Funding is the activity of giving financial resources normally in the kind of currency to other values such as efforts or time, to finance want programs and projects. On another hand, finance is the amount of total money given to the company with an outlook to repay and the firm is liable to pay back the capital amount along with a certain percentage of interest(Odden and Picus, 2018). This study is based on EUROCARIB tour operators. It is a major London-based European tour operator. This report will explain CVP analysis and its importance in financial management as well as different pricing methods. It will analyze different factors that influence on profits of the company. It will explain various kinds of management accounting information. Furthermore, the report will assess utilize of investment appraisal techniques and different sources as well as the distribution of funding to the company. It will interpret ratio for probability, liquidity, and investment of the particular company.

TASK 1

A. Concept of CVP analysis and its importance in financial management

Cost Volume Profit Analysis(CVP):

CVP analysis is kind of cost accounting. It is easy model that helpful for elementary direction and for short run judgements. It is planning procedure that management utilize to anticipate future of volume of action, incurred costs and sales mode as well as profits received. There are different elements includes such as level or volume of action, selling price of unit, variable cost per unit, total fixed costs, direct and indirect workforce(Sclar, Lönnroth and Wolmar, 2016). This analysis is categorised that is fixed and variable costs. Fixed costs are expenditure that don't fluctuate directly with volume of unit manufactured. The fixed cost become smaller percentage of total income while variable cost remain constant percentage as increased production level.

Importance of CVP analysis:

CVP analysis is important for researching relationship between volume, cost and profits. It gives an overview of process of planning profits. It is also assists to analysis the objective and rationality of such budget and forecasts. There are many ways that CVP analysis is very essential for financial management in the EUROCARIB. Such as:

- It is very helpful to administration as it gives perception into effects as well as inter-relationship of factors the affects on profits.

- With the help of it, identify maximum sales volume to neglect losses.

- CVP analysis is important to evaluate fixed cost and variable cost.

- It is find out profitable collection of cost and volume.

- It is important to determine profitability by sales and cost of production.

- The utilization of CVP to anticipate and analysis the deduction of its short run judgement regarding fixed value, marginal price, sales volume as well as selling cost for its plans of profits on constant basis(Cost Volume Profit Analysis,2018).

- CVP analysis is essential to profit planning, controlling on costs, implementing sales strategies and decision making.

Through CVP analysis, company easily identify cost and volume for selling price and level of production. Therefore, EUROCARIB tour operators follow cost volume profit analysis for planning of holiday trip in Caribbean. With the help of it, tour operators easily determine cost and sale volume of holiday trip.

B. Analysis of different pricing methods used by EUROCARIB to determine the price

Price of the products and services play an important role in identifying the value of product and services being produced by the organization. There are different pricing strategies used by different companies to determine the price of products and services. EUROCARIB in order to determine the price of product can use the following strategies :

- Market penetration pricing method : This method assist in determining the price of product by entering the market with keeping the price of products and services lower to attract customers towards the organization and influence them to change their existing brand for their products and services which are being offered at the low prices (Wang, Xiang and Fesenmaier, 2016). Market penetration helps in maintaining the price of product lower at the initial stages of the business and after the organization gain enough customers increases the price of product and also provide them high quality products and services to retain the customers in business. EUROCARIB can use this pricing method in order to attract more customers for the travel to Caribbean summer holiday to increase its market share and profitability.

- Cost – based pricing method : In cost – based pricing method The price of the product is determined on the basis of cost of production by adding profit margin to the cost the selling price of the product and services is determined (Varasteh, Marzuki and Rasoolimanesh, 2015). Cost – based pricing method include adding desired profit margin to the cost product to identify the final price of the product(4 Types of Pricing Methods – Explained, 2018). EUROCARIB can use this pricing method to determine the price of product On the basis of cost of incurred to provide that product and service to customers.

- Competition – based Pricing method: The price of the product is determined on the basis of prices of competitors offered for their products and services. The Organization uses this method to provide competitors with tough competition by offering the prices to customers by determining the prices offered by competitors to their customers (Armenski, Dwyer and Pavluković, 2018). This method helps in attracting customers towards the brand. EUROCARIB can use this method to attract more customers towards the brand by setting the price of product and services on the basis on competitors price of goods and services.

C. Factors affecting profitability of EUROCARIB

There are various factors which affect the profitability of the EUROCARIB. The following are various factors which have their influence on EUROCARIB operations:

Social factors: These factors include Social trends which have their influence on the profitability of the tourism sector. These factors include customers preference , demand, safety and security of society etc (John and Susan, 2015). These factors have its impact on the EUROCARIB profitability that can leads to reduction in customers and also effect reducing the demand of product and services offered by EUROCARIB.

Seasonal changes: It refers to changes in season which have its impact on the profitability of EUROCARIB. Seasonal changes leads to changes in demand of customers for traveling to particular destination in that particular season. Eurocarib will have less profitability in summer season as the demand for tourism is less in that season as compared to winter season. The demands for tourism increases in winter which helps in generating more revenues for the travel and tourism sector.

Current trend: The profitability of EUROCARIB is affected by changes in trend of tourism. The current trend of tourism include adventure tourism , nature tourism and cultural tourism which is gaining popularity in the industry and attracting more customers towards the organization. The current trend of tourism destination is changing as per different generation people such the young generation prefer adventure trip whereas old generation prefer religious and culture trips. EUROCARIB in order to attract more customers towards the brand must provide travel according to the preferences of different people and must not stick of only one type of tourism.

Political Factors: Political changes affect the profitability of travel and tourism sector. Political factors includes changes in government norms and policy and also refers to changes in government due to which there are various changes in laws which affect the profitability of this sector (Wicker and et.al., 2017). The taxation policy of government affect travel and tourism sector due to which the organization have to pay taxes to government from their profit which leads to reduction in profitability of the firm. EUROCARIB profitability is affected by various policy formulated by government.

TASK 2

A. Different types of management accounting techniques can be used in EUROCARIB

There are different management accounting techniques used by Eurocarib to improve the performance of organization which includes budgets, financial statements , variance analysis and forecasts.

Financial statements: These are the statements prepared by the company in order to measure its performance and profitability . Financial statements contains the information relating to financial transaction which assist in determining the profitability of the firm (Rogerson, 2017). Financial statements include income statements, balance sheets and cash flow statements. Income statements is as report which include income and expenses pertaining to specific period which helps in identifying the net profit and loss for the period. Balance sheets in financial information is prepared to identify the position of organization at a particular point of time.

Balance sheet consist of assets and liabilities of the organization which helps in determining the financial position of the firm (Wang, Cole and Chen, 2018). Cash flow statements are the reports prepared to identify the cash inflow and outflow for the particular period. It helps in determining the minimum cash requirements of the firm to perform its various operation. Eurocarib can use financial statements for improving its performance on the basis of financial statements' organization is able to make forecast of its various expenses which affect its performance level and can make strategies to reduce those expenses.

Variance analysis : Variance analysis helps in identifying factors due to which the performance of the organization is not achieved (Airey, 2015). Variance analysis helps in improving performance by measuring the organization by measuring the actual performance with planned in order to identify variances in the performance on the basis of which necessary action are taken to achieve the performance goals of the firm on the basis of variance analysis. Eurocarib can use this technique to improve its performance by analyzing the variances in performance by measuring standards set for performance with actual.

Budgets: Organization is able to improve the performance of its various functions by preparing budgets which assist in comparing the actual with the budgeted targets to improve the performance of the company (Chiu and Yeh, 2017). Budgets include estimates of expenses and incomes to identify the future profitability which helps in improving the performance by identifying variances which affect performance of the firm. Eurocarib can use this technique for improving the performance of the organization by preparing budgets which assist in making comparison.

Forecast :Eurocarib can use forecasting for improving the performance of the organization by making forecast of its various activities (DeFranco, Morosan and Hua, 2017). Forecasting involves making estimates for the future operations to make planning according on the basis of estimates to achieve the goals of the organization by improving performance. Forecast helps in identifying various threats which may affect the performance of the business to take necessary steps to reduce the threats and achieve the goals of business. Eurocarib can use this technique for improving its performance which helps in increasing its profitability and identifying the future sales target to plan accordingly to achieve those target.

B. Use of investments appraisal techniques as a decision – making tool.

Payback period : Payback period refers to the period which is required to recover the initial cash of investment. This method of calculating returns from the investment is easy to calculate.

|

Year |

Project A |

Cumulative cash inflows |

Project B |

Cumulative cash inflows |

Project C |

Cumulative cash inflows |

|

1 |

26600 |

26600 |

4600 |

4600 |

11200 |

11200 |

|

2 |

26600 |

53200 |

6200 |

10800 |

8600 |

19800 |

|

3 |

26600 |

79800 |

8000 |

18800 |

6600 |

26400 |

|

4 |

26600 |

106400 |

10000 |

28800 |

0 |

26400 |

|

Particulars |

Project A |

Project B |

Project C |

|

Initial investment |

80000 |

20000 |

20000 |

|

Payback period |

80000 / 26600 = 3.01 years or 3 years approx. |

3 + 1200 / 10000 = 3.1 years or 3 years and 1 month approx. |

2 + 200 / 6600 = 3.03 years or 3 years approx. |

On the basis of project A , project B and project C it can be interpreted that the payback period of project A is 3 years which is less than the time of project B and C. So, it is recommended to Eurocarib to select the project A as decision making tool for investment appraisal.

Average rate of return (ARR) : It refers to measuring the profitability of the firm on the basis of financial statements rather than cash flows. ARR is calculated by the formula = average income / average investment over the life of projet.

|

Year |

Project A |

Project B |

Project C |

|

1 |

26600 |

4600 |

11200 |

|

2 |

26600 |

6200 |

8600 |

|

3 |

26600 |

8000 |

6600 |

|

4 |

26600 |

10000 |

0 |

|

Average earnings after tax |

26600 |

7200 |

6600 |

|

Average investment |

80000 |

20000 |

20000 |

|

ARR |

33.3% |

36% |

33.0% |

On the basis of above computation it can be interpreted that Eurocarib in order to choose the most profitable project must choose the project B for higher returns. Project b is providing 36% Average rate of return which shows that the project B will be profitable for eurocarib.

Net present value :Net present value shows the difference between the future cash flows of an investment with the amount of investmnet.

Computation of Net present value (NPV)

|

Year |

PV factor @ 10% |

Project A |

Discounted cash inflow |

Project B |

Discounted cash inflow |

Project C |

Discounted cash inflow |

|

1 |

0.909 |

26600 |

24182 |

4600 |

4182 |

11200 |

10182 |

|

2 |

0.826 |

26600 |

21983 |

6200 |

5124 |

8600 |

7107 |

|

3 |

0.751 |

26600 |

19985 |

8000 |

6011 |

6600 |

4959 |

|

4 |

0.683 |

26600 |

18168 |

10000 |

6830 |

0 |

0 |

|

Total discounted cash inflow |

84318 | 22146 | 22248 | ||||

|

Less: Initial investment |

80000 |

20000 |

20000 |

||||

|

NPV |

4318 |

2146 |

2248 |

On the basis of above computation it can be concluded that project A must be chosen by Eurocarib as it is showing the highest value among the three which shows project a is profitable for the firm.

TASK 3

A. Financial statement of Thomas cook and interpretation of financial statement with the help of profitability, liquidity and investment ratios

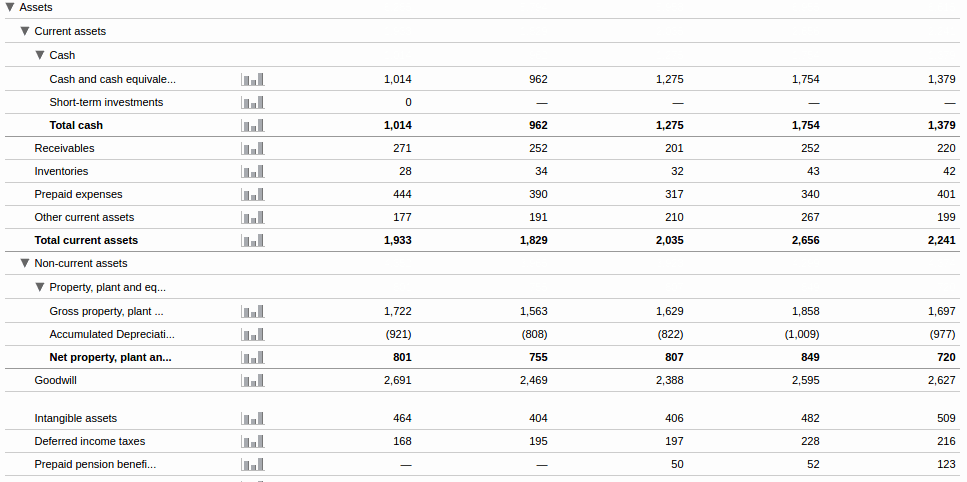

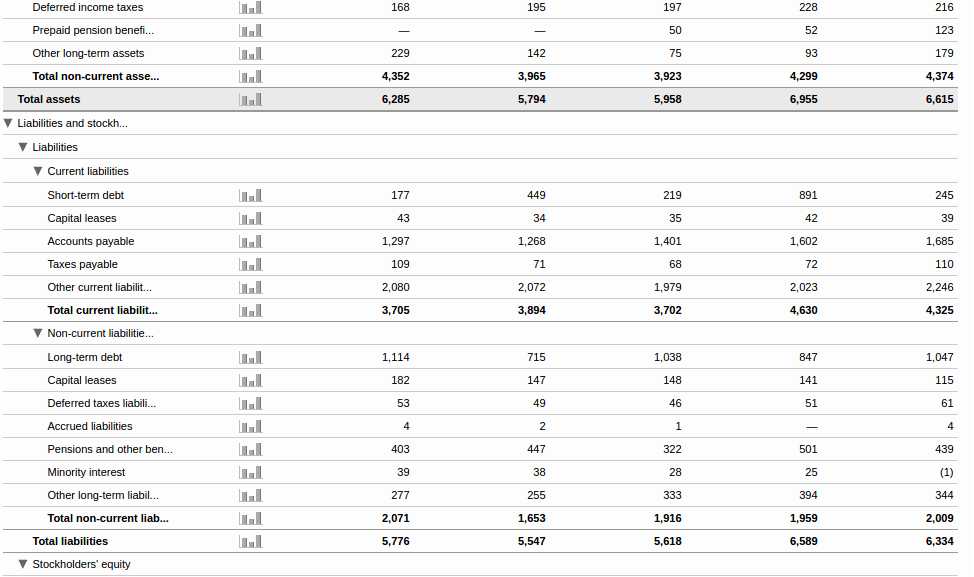

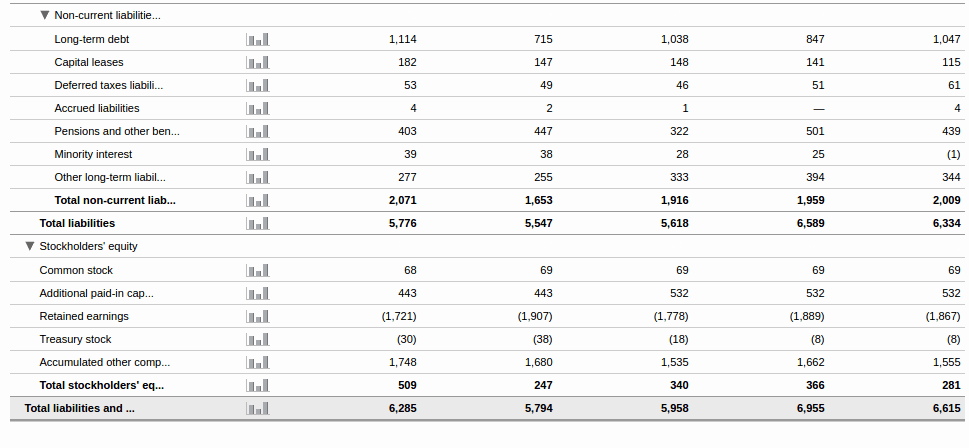

Balance sheet of Thomas cook: Balance sheet is prepared by Thomas cook to identify its

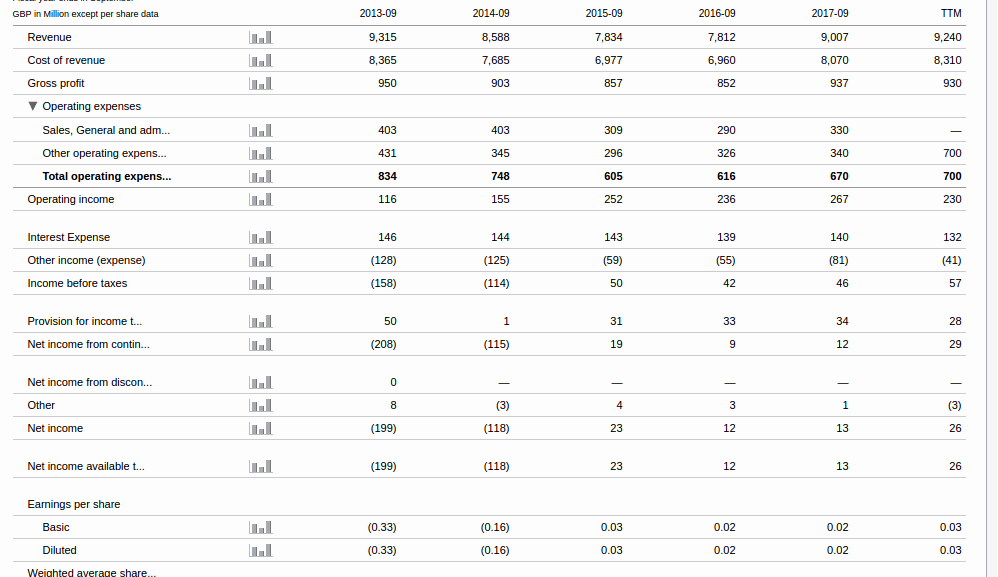

Income statements of Thomas cook: Income statements shows the profitability of the Thomas by considering the incomes and expenses for the period.

Thomas cook ratio analysis :

|

Profitability ratio analysis |

|||

|

2016 |

2017 |

||

|

Gross Profit |

852 |

937 |

|

|

Net profit |

12 |

13 |

|

|

Sales revenue |

7812 |

9007 |

|

|

Earnings before interest and tax or operating profit |

236 |

267 |

|

|

Capital employed |

366 |

281 |

|

|

Net income |

12 |

13 |

|

|

Average total assets |

|||

|

GP ratio |

Gross profit / sales * 100 |

10.9% |

10.4% |

|

NP ratio |

Net profit / sales * 100 |

0.15% |

0.14% |

|

Return on capital employed |

EBIT / capital employed |

64.48% |

95.02% |

On the basis of this analysis , it can be interpreted about the profitability ratio which was 64.48 % in 2016 has been increased to 95.02 % in 2017. According to this analysis the profitability of the Thomas cook has been increased in 2017.

|

Liquidity ratio analysis |

|||

|

2017 |

2018 |

||

|

Current assets |

2,656 |

2,241 |

|

|

Current liabilities |

4,630 |

4,325 |

|

|

Inventory |

43 |

42 |

|

|

Prepaid expenses |

340 |

401 |

|

|

Quick assets |

2273 |

1798 |

|

|

Current ratio |

Current assets / current liabilities |

0.57 |

0.52 |

|

Quick ratio |

Current assets - (stock + prepaid expenses) |

0.49 |

0.42 |

On the basis of this analysis it can be interpreted about liquidity ratio which are used to measure the firms' ability to meet its financial obligation. This analysis has shown that current ratio of the Thomas cook was 0.57 in 2017 which reduced to 0.52 in 2018 that shows that the liquidity position of organization is poor. Also, quick ratio of Thomas cooks reduced to 0.42 in 2018 from 0.49 in 2017 which shows that its liquidity position is getting poor the ideal quick ratio of the organization is 1 : 1.

|

Investment ratios |

|||

|

2016 |

2017 |

||

|

Earnings per share |

(Net income - preferred dividend) / Number of shares outstanding |

0 |

0.01 |

On the basis of this report it can be interpreted that the earning per share of Thomas cook has increase to 0.01 in 2017 from 0 in 2016 which shows the earning of Thomas cooks rare increased.

Students also like to read about: Management Accounting and its importance - EverJoy Enterprises

TASK 4

A. Sources of funding available for Eurocarib for development of new hotel

There are different sources of funding available for Eurocarib to build a new hotel. Funds are required to perform various activities of the organization. Eurocarib require £25 million for development of hotel. These fund can be arrange by eurocarib by internal and external sources of finance.

Internal sources : Internal sources of funding is related to acquiring funds from within the organization. Internal sources of funding include retained earning, sale of fixed assets , sale of stock and debt collection.

Sale of fixed assets : It refers to selling of the unused fixed assets such as furniture, machinery and plant, building etc. Funds acquired through the sale of fixed assets is the easy way to get funds for performing various activities of the organization. Eurocarib can use this source of funding for acquiring funds for the development of new hotel.

Retained earnings : This is the another source of finance which is adopted by various organization to fund their operations (Airey and et.al., 2015). Retained earnings are the profits of the organization which are used for performing the operations of business and are not shared with shareholders as part of dividends. Retained earnings helps in acquiring funds from within the organization which helps in reducing cost of organization to find different sources of funding to perform their various tasks. Eurocarib can use this source of funding for acquiring funds for the development of new hotel in Caribbean.

Debt collection : The organization can also adopt funds by collecting the amount which is due from customers. Debt collection refers to collecting the amount from customers which is due for providing them products and services by giving them credit for the specific period (Gurtner, 2016). Debt collection helps in acquiring funds for Eurocarib to build a new hotel which will cost £25 million.

External sources : It refers to acquiring funds from outside the organization to perform various operations of the business. External sources of funding include debentures, bank loans and trade credit.

Bank loans : It refers to acquiring funds from banks to perform various activities of the organization. Bank loans are provided by banks on which interest is charges by bank to acquire the funds for operations.

Debentures : Debentures are the another source of external sources of funding which is available to Eurocarib for acquiring funds for the development of the new hotel in Caribbean. Debentures are issued to public for the specific time after which the debentures amount is provided to public on the maturity of the debentures (Becker, 2016). The organization have to give the interest amount for using the debentures for operating various activities.

Trade credit : It refers to taking credit from the suppliers and traders to operate firm activities. Trade credit is provided by suppliers for the specific time after which the organization have to pay the amount of credit provided by trade creditors. Eurocarib can use this source for acquiring funds for developing the new hotel in Caribbean.

You can also check: Write My Essay

CONCLUSION

From the above study it had been concluded about finance and funding inn travel and tourism sector. It refers to ways through which organization is able to acquired funds for its various operations. This study has provided with the cost – profit volume analysis which has included fixed cost, variable cost which remain constant. Furthermore, the assignment has provided with the analysis of different pricing methods which has helped Eurocarib in determining thew price of products and services. Different pricing methods has included cost–based pricing, competition based pricing and market penetration.

Moreover, this project has provided with different management accounting information techniques which has supported Eurocarib in improving its performance by using Budgets, forecast, financial statements and variance analysis. Also, it has provided with different investment appraisal techniques as decision- making tool. This assignment has also provided with the financial statements which are interpreted using rations of profitability, liquidity and investment. This study has also provided with different sources of funding available for Eurocarib to build a new hotel which has provided Eurocarib with internal (retained earnings, sale of fixed assets, debt collection etc.)and external sources(bank loans, debentures and trade credit etc.)

REFERENCES

- Airey, D. and et.al., 2015. The managerial gaze: The long tail of tourism education and research. Journal of Travel Research. 54(2). pp.139-151.

- Armenski, T., Dwyer, L. and Pavluković, V., 2018. Destination competitiveness: public and private sector tourism management in Serbia. Journal of Travel Research. 57(3). pp.384-398.

- Becker, E., 2016. Overbooked: the exploding business of travel and tourism. Simon and Schuster.

- Chiu, Y.B. and Yeh, L.T., 2017. The threshold effects of the tourism-led growth hypothesis: Evidence from a cross-sectional model. Journal of Travel Research. 56(5). pp.625-637.

- DeFranco, A.L., Morosan, C. and Hua, N., 2017. Moderating the impact of e-commerce expenses on financial performance in US upper upscale hotels: The role of property size. Tourism Economic