“Impact of Brexit on the united kingdom and EU's financial regulations”

Financial market is a place where people buy and sell their financial securities. It is a broad term which comprises trading of equities, bonds, derivatives, currencies etc. at less transaction cost. In this, prices are decided at the point of intersection point of demand and supply hence it may not indicate the real intrinsic value of the stock. Along with this, prices largely rely upon the transparency of information given by the issuing company so as to assure efficient and appropriate price (Aldohni, 2016). For instance, derrivative, Forex, Over-the-counter (OTC), Bond, Money and Stock market etc. are several kinds of financial market where people purchase and dispose of their variety of securities for different objectives. On the other hand, financial institutions are the establishments which carry out the investment, accept deposits, provide loan and conduct other financial activities. For instance. Commercial banks, assets management firms, stock brokerage firm, credit union etc. are the several types of financial institutions. In the present age, almost each and every person deals with the banks to deposit their savings and take loans to fulfil their capital requirement. All these institutions are regulated and supervised by certain rules, regulations, guidelines and restriction which are known as the financial regulations (Dwyer, 2016). The main aim of such is to maintain integration of the system by conducting their operations precisely and legally.

Strictly abiding with the regulatory provisions is must because it plays an important role in the economic growth and development. The reason behind this is that such nations which have adequate finance are identified very strong so it will be able to deal with the volatile market situations and patterns. Contrary to this, countries which are facing difficulties due to insufficient quantum of finance, their profit and losses are dependent upon the recession and boon. Financial regulations mainly include policies, guidelines and legal regulations which are decided by the government. Both the private as well as public institutions are legally liable to follow these principles and restrictions so as to maintain high level of integrity. This policy influence and regulate the daily operations of the financial sector in order to assure the financial stability (Naser and Hassan, 2016). The main importance of the regulatory practices is they eliminate instability which can be arise due to high rate of interest, market uncertainty, adverse economic shocks etc. These restrictions and supervisions have been introduced by the government to ensure effective functioning of the system by absorbing shocks and building stability.

EU is political union of 28 member states which are located in the country of Europe. It has developed a uniform legal system and applied for all the countries that are part of EU. The major aim of EU policies comprises of freedom of movement of people, services, goods, capital etc. within its internal market. Moreover, applying standard policies on all the trading practices are also its main objective. Furthermore, in the monetary union, it has been declared that all of the member nations are allowed to use EURO as their currency while other European nations can use pound only (Wallace, Pollack and Young, 2015). According to the scenario, EU successively launched wide range of regulatory initiatives which aimed at ensuring great level of integration by the removal of trade barriers which may hindered the cross-border services across Europe continents. With regards to EU, financial regulations are of great significance due to varied reasons. For instance, monetary instability due to sudden increase in interest rate eventually can bring larger decline in the lending and may collapse the loan market. It negatively affected the borrowers because the cost of debt will be increased and as a result, they have to pay more money for the loan repayment (The role of financial regulations, 2016). Along with this, uncertain market situations due to recession, political instability, crash of stock market also declined the financial system's ability to screen fund borrowers and may lead to credit rationing. Therefore, in this respect, enforcement of legislations, regulations and policies ensure effective cash flow within the nation and provide safety from being bankrupt by administrating inflow and outflow of money (Casu and et.al., 2016).

Regulatory provisions of the financial sector also influence the banking structure, decline cost of borrowing and enhance the product portfolio of the corporate sector. It maintains market confidence, secures consumer protection, reduces crime by consistent supervision and also regulates foreign participation in the market. In UK, Bank of England (BOE), Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) are the regulatory authorities which establish their control over monetary activities of the institutions. However, EU's laws comprise of European Banking Authority (EBA), European Securities and Market Authorities (ESMA), European Insurance and Occupational Pension Authority (EIOPA) and European Systemic Risk Board (ESRB) etc (Kudrna, 2016). Eurozone nations formed a uniform supervisory mechanism under the European Central Bank. For instance, licensing system, minimum capital, maintaining reserves, corporate governance, disclosure of their performance, credit rating requirement etc. are several regulations which all the EU member states needs to follow while carrying out their operations.

Moreover, UK's FCA also imposed penalties to the institutions which do not took reasonable care in the prevention of restricted practices like bribery and the risk of corruption as well. Along with this, it also regulates UK banking and insurance sector to protect whistle-blowers. Compliance with the EU and UK law, protection of customer rights etc. are the primarily need through which the financial market are abided (Enriques and Zetzsche, 2015). Apart from it, regulations are also necessary because informational asymmetries and lenders inability to monitor borrowers lead to increase agency cost and thereby impact the financing cost as well. It affects firm’s borrowing capabilities as negative shocks to the market value decline the value of the assets which can be used by the organizations as a collateral security. This in turn, financial market will be less willing to lend money because of higher possibility of the potential loss.

It must be kept in mind that only two nations that are Denmark and UK do not have legal compulsion to join EURO. Hence, in UK, Bank of England regulates the institutional practices and regulations whilst all the other countries are complying with ECB's policies (Dwyer, 2016). Therefore, these two different regulators in a single market are considered as an issue. Although, both the regulations are in close cooperation but still, many differences are existed which bring a difficulty in the proper functioning of the financial market (Leuz and Wysocki, 2016). Moreover, interest of tax contributors is also represented differently by both the nations and arisen issue. Another problem is regarding the regulatory offices and their physical location. Thus, it becomes clear that setting a uniform set of policies becomes necessary for the successful operation of the financial sector.

Scenario stated that, recently UK left the EU on 23rd June 2016. As a result, UK is required to change their regulatory framework and laws. It is because global financial service provider institutions that use London subsidiary is required to restructure themselves and take decisions that how much of their operations should be transferred elsewhere in EU (Vazquez and Federico, 2015). It will impact both UK and EU to a major extent. Most importantly, after leaving EU, UK will not be able to take the benefits of FTA. As a result, they cannot carry out cross border transactions which in turn will decline their trading volume. Along with this, it can also decrease the attractiveness of UK for the investment purpose. Thus, its serious impact will be that it jeopardise UK trade and investment. Moreover, new regulatory regime in UK also would be likely to come into existence. On the other hand, according to Norwegian model, separation of EU and UK will not provide political flexibility to Brexit. Contradicting this, UK trade with the EU as a most favoured country hence, it definitely provide flexible arrangements to the nation (Battiston and et.al., 2016).

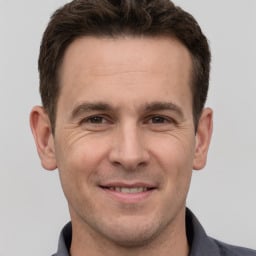

The impact of Brexit on the EU and UK relationship can be greatly evaluated by examining the Brexit paradox. In this, Swiss and FTA based models are the most likely approaches. In accordance with this, regulatory divergence will increase the cost of trade and damage the trade volume and the position of UK in the EU's supply chain. Such high cost need to be bear by both the consumers and businesses (Driffield and Karoglou, 2016).

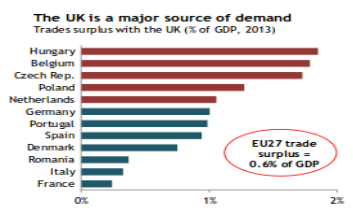

The Swiss and FTA relationship states that both the nations are the most important trading partner of each other. Moreover, Brexit will also affect EU in the terms of Foreign Direct Investment (FDI), liberalisation, immigration, trade and industrial policy, financial services, budget and uncertainty etc. Breaking relationship with EU will influence UK negatively as it will be less attractive nation in the terms of getting investment from rest of the European Union countries. (Flower, 2016). This in turn, UK needs to take necessary actions to undercut the EU standards so as to attract more FDI for the economic growth and development. Moreover, restriction on cross boundaries transactions will also create an adverse impact. It is because UK cannot gain freedom in the movement of goods and services across various nations of the EU. Besides this, its severe impact will be that it will become harder for the EU to block minority due to illegal measures

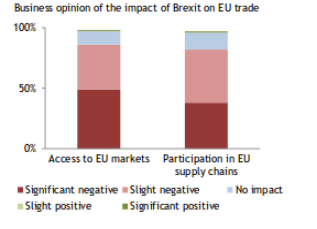

However, loosing collaboration in the research and weakening of competition policy are the two other disadvantages for EU. Regarding to trade policy, it can be much harder for the UK to resolve their trade disputes. Contrary to this, EU will be less attractive trading nations without having UK as a member country. Moreover, EU can lose their budgetary discipline because UK is one of the major net contributors to the EU. Furthermore, risk due to political contagion and uncertainty has unfavourable impact on the business in EU. Besides this, in the supply chain, half of the EU imports are intermediates with the UK. Thus, it can be said that it will significantly reduce their trading (Flower, 2016). However, in the comparative study, it has been founded that EU is a greater important commercial partner of the UK than UK is for EU. On the contrary to this, UK is a major source of demand for the EU countries. 1/10th of the total EU exports are particularly to UK whilst 50% of UK exports are to EU. Thus, the imbalance in trade will increase their UK's trade deficit with the rest of the EU nations.

Apart from this, with the EU membership, UK is able to take advantage which demonstrates that British Bank and other insurance companies can render their services across EU. After Brexit, it will not be possible unless a special negotiation has been arranged. Moreover, if the UK is willing to continue their operations with the rest of the EU countries, than they have to comply with the EU regulations so as to meet the requirement of equivalents assessment. Currently, many of the UK laws came from EU legislation hence; such rules will remain applicable until the changes will be made (Piere, 2016). Further, it may be possible that new UK laws and regulations might be compatible with the EU legislations hence it may bring significant risk in the financial market. Further, UK is largely dependent upon the EU due to heavy export of their financial services. Therefore, institutions needs to apply various contingency plans so as to get continue access to the single market. Along with this, longer impact of the decisions to leave EU will be on the UK's regulatory framework.

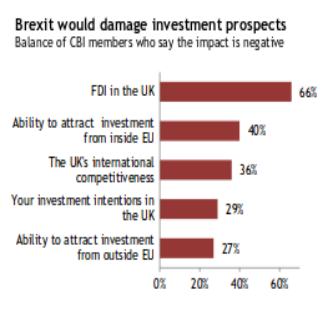

According to the pie diagram, it can be seen that UK is the largest contributor of FDI in the EU. Therefore, breaking down the relationship may reduce the UK attractiveness as a European gateway. Falling in investment from the rest of the EU is also an unfavourable impact of Brexit. However, contradicting to this, it has also been identified that UK has many advantages which will not affect the relationship breakdown such as light regulations, language, deep capital markets etc (Piere, 2016). On the contrary to this, Brexit not only damage the FDI but also adversely impact UK's investment intention.

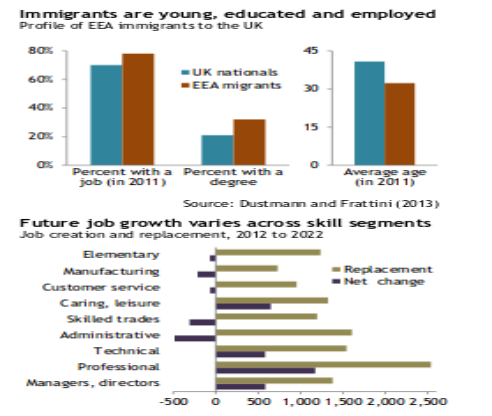

EU countries heavily invest money in various sectors across UK. FDI largely comes from several host countries like Germany, France, Spain, Ireland etc, particularly in energy, wholesale trade, transportation, manufacturing sector etc. Therefore, ending relationship with the EU can bring risk for UK because lower the level of FDI will adversely impact job opportunities and create a negative impact on the unemployment rate. Apart from this, according to OECD, UK is the least regulated nation as compare to other countries. Thus, there was not any conflict between EU regulations and liberal market economy (The impact of Brexit on the UK and EU, 2015). However, after Brexit, it will create a serious impact due to high regulations such as taking planning permission and abiding with the rules and regulations etc. On the contrary to this, with regards to immigration, post Brexit paradox will not allow UK firms to gain talented, experienced and specialist skills of workforce from the other nations. Hence, they cannot add high value in their products and services to meet their customer demand effectively. Thus, from the essay, it can be concluded that Brexit will impact positive positively as well as negatively to EU and UK.

References

- Aldohni, A. K., 2016. Is Ethical Finance the Answer to the Ills of the UK Financial Market? A Post-Crisis Analysis. Journal of Business Ethics.

- Battiston, S. and et.al., 2016. Complexity theory and financial regulation. Science.

- Casu, B. and et.al., 2016. Diversification, size and risk: The case of bank acquisitions of nonbank financial firms. European Financial Management.

- Driffield, N. and Karoglou, M., 2016. Brexit and Foreign Investment in the UK. Available at SSRN 2775954.

- Dwyer, R., 2016. A FINANCIAL INSTITUTIONS. World Banking Abstracts.

- Enriques, L. and Zetzsche, D., 2015. Quack Corporate Governance, Round III? Bank Board Regulation Under the New European Capital Requirement Directive. Theoretical Inquiries in Law.

- Flower, J., 2016. European financial reporting: adapting to a changing world. Springer.

- Kudrna, Z., 2016. Governing the EU financial markets. Comparative European Politics.

- Leuz, C. and Wysocki, P. D., 2016. The economics of disclosure and financial reporting regulation: Evidence and suggestions for future research. Journal of Accounting Research.